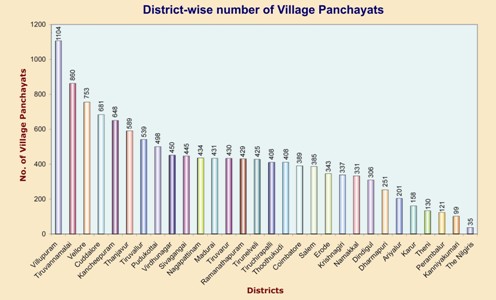

There are 12,620 Village Panchayats in the State spread across the 30 districts and the 385 Blocks. The average number of Village Panchayats per district is 421 and per Block is 32. The Nilgiris (35), Kanniyakumari (99), Theni (130) and Karur (158) are some of the districts with fewer Village Panchayats while Villupuram (1104), Tiruvannamalai (860), Vellore (753), Cuddalore (683) and Kancheepuram (648) are some of the districts with a large number of Village Panchayats. As can be seen from Table 5, the population of Village Panchayats in Tamil Nadu is widely varying with some Village Panchayats having populations even below 500 while others have populations exceeding 25,000.

* In addition to the 681 Village Panchayats in Cuddalore District, two more Village Panchayats viz. Perumathur and Indira Nagar have been newly constituted in Kurinjipadi Panchayat Union and have started functioning from 18.8.2008.

Table- 5

Classification of Village Panchayats on the basis of Population

(2001 Census)

1 |

Below 500 |

66 |

2 |

501-1,000 |

1,177 |

3 |

1,001-3,000 |

7,241 |

4 |

3,001-5,000 |

2,571 |

5 |

5001-10,000 |

1,379 |

6 |

Above 10,000 |

186 |

|

Among the three tiers, Village Panchayats assume a pre-eminent role in view of the wide variety of civic duties and other functions entrusted to them under Sections 110 and 111 of the Tamil Nadu Panchayats Act, 1994. This Government have always taken efforts to empower the Village Panchayats further in order to enable them to perform their functions in an effective manner. Various efforts have been taken by this Government to improve the finances of the Village Panchayats.

Since the Village Panchayats in Tamil Nadu vary widely in population from below 500 to above 25,000 and as the devolution of State Finance Commission grant is mostly linked to population, the smaller Village Panchayats got less grant and the bigger Village Panchayats got more. While the needs of the bigger Village Panchayats are also greater, it is a fact that there are certain fixed costs associated with the running of a Village Panchayat irrespective of the size and the SFC grant to a Village Panchayat should be sufficient to cover at least the fixed costs, if not the variable costs. There were cases where some Village Panchayats found it difficult to pay their electricity bills on time; a few couldn’t pay the salaries and wages of their employees on time. The State Finance Commission recommended the earmarking of certain percentage of the SFC grant as ‘Equalisation Fund’ to assist such weaker Village Panchayats. But past experience showed that the allocation of the Equalisation Fund by Collectors was by discretion which introduced a certain element of arbitrariness.

The Government have thus passed G.O.Ms.No.199 Finance (Finance Commission – IV) Department dated 25.5.07 wherein a floor amount of Rs.3 lakh has been earmarked for each Village Panchayat irrespective of the population and only after the apportionment of this amount, the remaining amount is distributed among the Village Panchayats in proportion to population. By virtue of this decision of the Government, the huge disparity in the income of the Village Panchayats has been reduced and at the same time weaker Village Panchayats have been empowered further towards self-sustainable.

The Government have also vide G.O.Ms.No.19 R.D. & P.R.(C2) Dept. dated 26.02.2007 decided to allocate the entire Twelfth Finance Commission grant to the Village Panchayats alone as can be seen in Table-6 given underneath:

Table- 6

Income-wise Classification of Village Panchayats

-

|

Upto Rs.50,000 |

10 |

0 |

-

|

Rs.50,000 to Rs.1 lakh |

178 |

0 |

-

|

Rs.1 lakh to Rs. 5 lakhs |

7,422 |

1,021 |

-

|

Rs. 5 lakhs to Rs 10 lakhs |

3,181 |

7,146 |

-

|

Rs. 10 lakhs to Rs. 25 lakhs |

1,489 |

3,902 |

-

|

Rs.25 lakhs to Rs.50 lakhs |

252 |

393 |

-

|

Rs.50 lakhs to Rs. 1 crore |

60 |

121 |

-

|

Rs.1 crore to Rs.3 crores |

24 |

32 |

-

|

Above Rs.3 crores |

2 |

3 |

|

It is, hence, seen that the average income levels have not only increased for majority of the Village Panchayats but also the inequity of the income levels amongst various Village Panchayats has decreased due to the steps taken by the Government.

9.1. Functions

Sections 110 & 111 of the Tamil Nadu Panchayats Act, 1994 prescribe the duties and functions of Village Panchayats. Some of the important functions of a Village Panchayat are:

a) Construction, repair and maintenance of all village roads.

b) Extension of village sites and the regulation of buildings.

c) Lighting of public roads and public places in built-up areas.

d) Construction of drains.

e) Cleaning of streets and improvement of the sanitary condition of the village.

f) Construction and maintenance of public latrines.

g) Sinking and repairing of wells, the excavation, repair and maintenance of ponds or tanks and the construction and maintenance of water-works for the supply of water.

h) Maintenance of burial and burning grounds.

i) Maintenance of parks and reading rooms,

j) Implementation of schemes such as Indira Awaas Yojana (IAY) and National Rural Employment Guarantee Scheme (NREGS).

k) Such other duties as the Government may, by notification, impose.

9.2. Resources

The important sources of revenue for the Village Panchayat are:

a) Tax revenue:

Among the three tiers, the Village Panchayat alone has the power to levy taxes. House tax, Profession tax and Advertisement tax are the commonly levied taxes.

b) Non Tax revenue:

Licensing fees for building plan and layout approval, fees and charges on Dangerous & Offensive trades, water charges, fees on cart-stands, fishery rentals, 2C patta fees, income from markets and fairs, ferries, fines and penalties and so on.

c) Assigned and shared revenues:

These revenues include the items pooled at the State level (Local Cess, Local Cess Surcharge, Surcharge on Stamp duty and Entertainment Tax) which are released by the Director of Rural Development and Panchayat Raj to all the three tiers of the Panchayats including the Village Panchayats. Other items of Assigned and shared revenues for the Village Panchayats include the seigniorage fees (100%) and lease amount (50% share) on minor minerals and social forestry auctions amount.

d) Grants:

Central Finance Commission Grant, State Finance Commission Grant, development grants under Centrally-sponsored and State schemes.

9.3. Administrative powers

The Village Panchayat President himself has been designated as the Executive Authority. Cheques for payment have to be signed jointly by the President and Vice-President. Where the relationship between the two is not cordial, the Collector, in his capacity as Inspector of Panchayats, can designate any other member of the Village Panchayat as joint cheque signing authority along with the President.

The Government have brought out Tamil Nadu Panchayats (Preparation of Plan and Estimates for works and Mode and Conditions of works) Rules, 2007 vide G.O.Ms.No.203 R.D. & P.R. (PR.1) Department, dated 20.12.2007, wherein the Village Panchayats have been empowered to give administrative sanction and execute individual works up to Rs.2 lakhs from their General Funds. Previously the Village Panchayats were empowered to give administrative sanction for works up to Rs.1 lakh only. For all works costing more than Rs.2 lakhs but not more than Rs.50 lakhs, the District Collector is the competent authority to give the administrative sanction and for works costing more than Rs.50 lakhs, the Director of Rural Development and Panchayat Raj will be competent to accord administrative sanction. However, the Collector’s prior administrative sanction is necessary in respect of all Centrally sponsored and State funded schemes. Village Panchayats have also been given freedom to execute urgent works up to Rs. 2,000 at a time and up to Rs. 5,000 for a year without any technical approval. The President can draw self cheque up to Rs. 500 to meet contingent expenditures.

The Village Panchayats have been given necessary delegation of powers to enable them to attend to repairs and maintenance of hand pumps, power pumps and street lights promptly. They can spend Rs.600 per hand pump per year and up to Rs.7,500 per power pump per year without reference to engineers for preparation of estimates or passing of bills. They can buy street light materials meeting the prescribed quality norms on their own.